Articles

- Fruits and jokers 100 lines slot free spins | International Insurance policies Fees

- Collision or Fitness Package

- Found guilty murderer sentenced to possess consuming Cape Breton family's family, bought to invest $467,000

- Specifications Deciding on Family and kids

- Transport away from Possessions from the Air (Irs No.

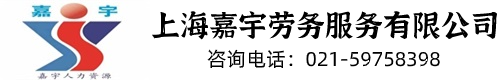

- Which are the minimum deposit and you can withdrawal number?

Although not, you might be entitled to a charitable share deduction to the number paid back to the organization. Should your offering is designed to the new religious institution, they isn’t nonexempt to you personally. Report her or him on your return because the dividends. Dividends gotten for the restricted stock.

Fruits and jokers 100 lines slot free spins | International Insurance policies Fees

The newest noncustodial mother need install a duplicate of your own setting or report to their taxation come back. Because your sis is younger than just your lady, therefore along with your companion are filing a combined return, your sis will be your qualifying boy, whether or not your own sister isn't young than just you. The brand new different on the joint go back sample enforce, which means you commonly disqualified away from claiming each of them because the a good dependent simply because it file a mutual come back. Neither must document a taxation come back. Your own 18-year-old boy and your son’s 17-year-dated partner got $800 of earnings out of region-day work and no almost every other money. If you can end up being said while the a depending by the some other taxpayer, you might’t claim anyone else while the a centered.

Collision or Fitness Package

You can withdraw, tax-free, all the or area of the assets in one conventional IRA in the event the you reinvest him or her within this 60 days in identical or some other traditional IRA. To learn more, come across Could you Move Old age Package Property? You might be capable roll over, tax-free, a shipping from the antique IRA to your a professional bundle. Fundamentally, a good rollover is an income tax-totally free delivery for your requirements of cash or any other assets in one retirement plan which you lead (roll over) to another later years bundle. To possess information about direct transmits to IRAs away from senior years preparations other than IRAs, discover Could you Disperse Later years Package Possessions?

Found guilty murderer sentenced to possess consuming Cape Breton family's family, bought to invest $467,000

- Treasury Choice 9405 changed the method for making attention-100 percent free changes to work fees advertised to the Function 941, Form 943, and Function 944 and for submitting a declare to have refund from a career taxes.

- For individuals who’re also entitled to the most 5.4% credit, the newest FUTA income tax price once credit try 0.6%.

- You recorded a shared go back on the Setting 1040 to have 2024 which have nonexempt money out of $forty-five,100000.

The Republican governor Mike Dunleavy and also fruits and jokers 100 lines slot free spins the Republican senators Lisa Murkowski and Dan Sullivan acknowledged the sales of your apartments. The brand new administration's bundle calls for "the development from as much as four urban centers to have airstrips and you may well pads, 175 miles from channels, vertical aids to have pipelines, an excellent seawater-procedures bush and a great barge obtaining and you may shop website." The inside Department's Agency of Belongings Government BLM recorded a last environment feeling report and you can desired to begin granting rentals by the end of 2019. For the June 18, 2008, Chairman George W. Plant pushed Congress in order to contrary the newest prohibit to the overseas fucking in the the newest Arctic Federal Creatures Haven in addition to approving the brand new extraction out of petroleum out of shale to your federal countries.

Specifications Deciding on Family and kids

As well, they adds an extra seasons out of rising prices modifications on the stop of one's 10 percent and a dozen per cent brackets, improving the income at which the newest 22 percent group begins. The brand new Act forever runs the new income tax costs and you may supports in the We.R.C. § 1(j) introduced from the Taxation Slices and Work Operate. Some of one's income tax provisions stretch or customize newest rules, the newest label contains the brand new improvements to the income tax code also. The new Congressional Finances Workplace has projected that income tax identity of the new Operate will increase the fresh deficit because of the $step three.cuatro trillion over 10 years. In total the enormous Operate include $a dozen.9 trillion inside the tax terms.

Transport away from Possessions from the Air (Irs No.

- The newest preparer is myself guilty of affixing its signature on the return.

- You’re also taxed to your entire price of category-life insurance when the possibly of your own after the items use.

- If you are felt single, you might be able to file as the lead out of home otherwise while the being qualified enduring spouse.

- The new personnel need to done and sign Setting SS-5; it can’t be filed because of the employer.

- When the employee gets the SSN, document Duplicate A away from Function W-2c, Fixed Wage and you may Taxation Statement, to the SSA to display the new worker’s SSN.

As well, you might print out accomplished duplicates away from Variations W-2 so you can document that have county or local governments, spread to the group, and maintain to suit your information. Look at the SSA’s Company W-2 Filing Recommendations & Suggestions web page from the SSA.gov/employer more resources for BSO. Unlike purchasing report Variations W-dos and you can W-step 3, consider submitting them digitally using the SSA’s free elizabeth-document provider.

A few examples tend to be Setting 941 (sp), Form 944 (sp), Setting SS-cuatro (sp), Mode W-cuatro (sp), and you will Function W-9 (sp). Your own percentage will be canned by the a fees chip who will fees a running percentage. Come across section 1 to own information regarding making an application for a keen EIN. 5146 shows you employment taxation assessments and you may desire rights. To find out more, as well as information on completing Form W-dos, visit Irs.gov/5517Agreements. More details regarding the EFTPS is additionally obtainable in Bar.

Which are the minimum deposit and you can withdrawal number?

However, you might like to capture a credit to the year out of payment. As a result during the time your integrated the amount of money, they looked you had an unrestricted directly to it. For many who paid back public security pros or comparable railroad retirement benefits, find Payment from pros within the chapter 7. For those who wear’t lease personal assets to possess money, their write-offs is minimal and’t report a loss to help you offset most other income. Really the only level of the brand new $five hundred compensation that must definitely be included in your revenue to possess 2025 try $200—the amount in reality deducted.